Analyst: Victoria Ejugwu*

v.ejugwu@vetiva.com

Target price: ₦2,102

Recommendation: SELL

Topline expands on improved output

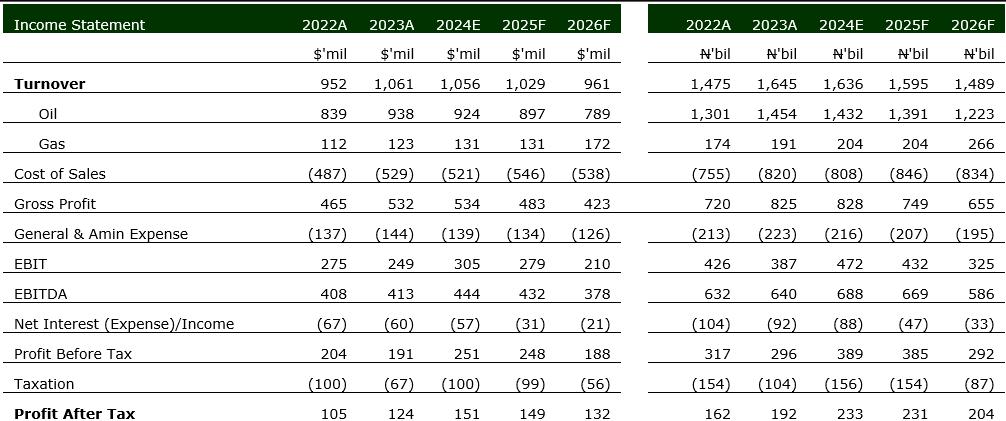

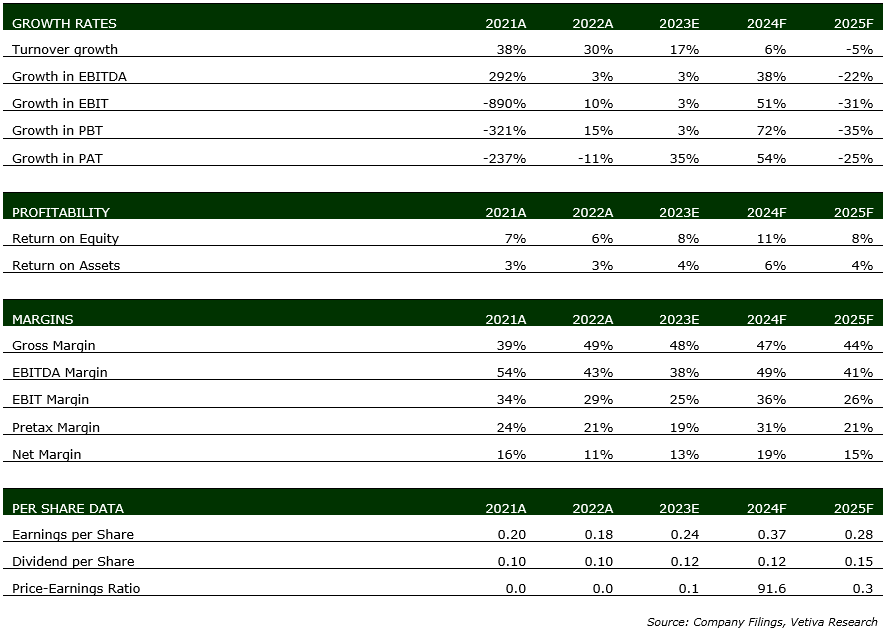

Amidst lower oil prices (-17% y/y), and in line with our estimates, Seplat grew its revenue by 12% y/y to $1.1 billion (inclusive of overlifts), driven by improved oil production. Stripping out overlifts, revenue only posted a 4% y/y growth. For specifics, oil receipts came in 12% higher y/y, as oil production increased 14% y/y to 10.3 mmbls (FY’22: 9.0 mmbls). Similarly, gas revenue came in 10% higher y/y, driven by a mix of higher pricing and increased output. Gas production inched up 3% y/y to 41 bscf, while average gas price inched up 6% y/y.

Operational performance dips on higher opex and FX losses

While Seplat was able to grow its revenue, operating profit dipped as foreign exchange losses and a higher Opex (+4% y/y), driven by litigation costs, pressured operating results. For specifics, the company’s operating profit declined 9% y/y to print at $249.3 million, as the company recognized a foreign exchange loss of about $27 million while general and administrative expense rose 5% y/y. However, given a lower tax expense due to deferred taxes, PAT increased 18% y/y to $123.9 million.

Outlook

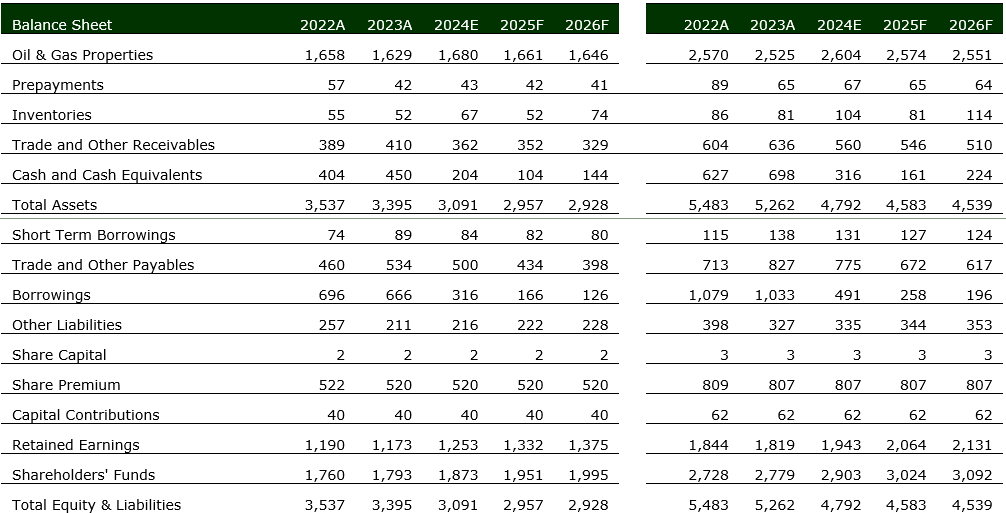

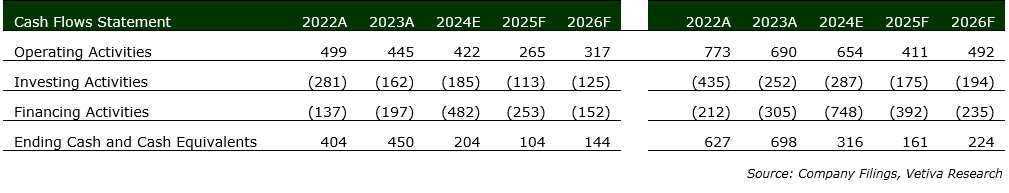

We only see modest upside for production growth in the new year, as much of Seplat’s drilling plan is aimed at arresting production declines in aging wells. That said, our projections for oil output prints at 11.4 mmbls (FY’23: 10.3 mmbls), while gas output is expected to come in at 44 Bscf (FY’23: 41 Bscf). Also, with oil prices set to average $80/bbl on a base case scenario, we anticipate a somewhat flattish performance in revenue, with revenue projected to print at $1.1 billion. On the operational front, we anticipate improved results, driven by the reduction of one-off costs, particularly litigation expenses, which negatively impacted the company’s operations in the previous fiscal year. This will bring our projections for operating profit to $304 million, up 22% y/y. Also, we anticipate some deleveraging in the year given the company’s positive cash position; thus, after accounting for finance costs and taxes, our projection for PAT prints at $150.5 billion. Overall, we value Seplat at ₦2,102 per share.

On the MPNU deal

Seplat still retains interest in acquiring Mobil producing Nigeria unlimited’s share of the MPNU/NNPC joint venture and awaits approval. However, there has not been certainty on when this approval will materialize, and as such, we have not factored in the potential impact from MPNU into our current valuations

/*! elementor – v3.16.0 – 17-10-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

Disclosures

The research analyst(s) denoted by an “*” on the cover of this report certifies (or, where multiple research analysts are primarily responsible for this report, the research analysts denoted by an “*” on the cover or within the document individually certifies, with respect to each security or issuer that the research analyst(s) cover in this research) that: (1) all of the views expressed in this report accurately articulate the research analyst(s) independent views/opinions, based on public information regarding the companies, securities, industries or markets discussed in this report. (2) The research analyst(s) compensation or remuneration is in no way connected (either directly or indirectly) to the specific recommendations, estimates or opinions expressed in this report.