Ibukun Omoyeni*

i.omoyeni@vetiva.com

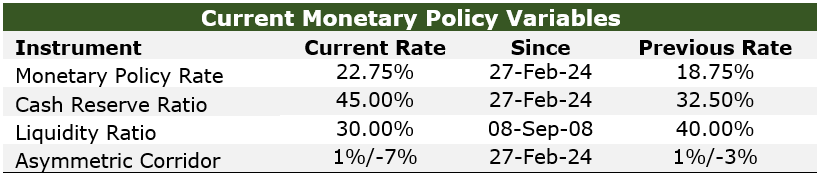

The Monetary Policy Committee (MPC) gave its first policy direction under the chairmanship of Dr. Olayemi Cardoso with all 12 members present. The Committee raised the Monetary Policy Rate by 400bps to 22.75%, the highest level since its introduction in 2006. In addition, the asymmetric corridor around the MPR was adjusted to +100/-700bps around the MPR. Finally, the Cash Reserve Ratio (CRR) was raised by 1,250bps to 45%.

/*! elementor – v3.16.0 – 17-10-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

Key considerations of the Committee were the current inflationary/exchange rate pressures and rising inflationary expectations. The decision of the central bank to transit to an inflation targeting framework underpinned the decision to tighten the MPR. In an earlier presentation, the Governor made his 2024 inflation target of 21.4% public, which is largely below our in-house expectation (Vetiva: 32.9% y/y).

The Committee also deliberated on distortions in the foreign exchange market and reforms undertaken so far including the unification of the foreign exchange market, promotion of a willing-buyer-willing-seller market, removal of limits for remittances through International Money Transfer Operators (IMTOs), promotion of price discovery in the Nigerian Autonomous Foreign Exchange Market (NAFEM), reforms in the Bureau de Change (BDC) segment of the market, and the introduction of a two-way quote system in the NAFEM. The Committee also noted the uptrend in reserves due to increased oil production and reforms.

CBN tightens the noose on banks, makes room for FPIs

The Committee considered various scenarios of hold and hike, and concluded that, inflation could become more persistent in the medium-term and thus pose more regulatory challenges if not effectively anchored. The balance of the argument thus leaned convincingly in favour of a significant policy rate hike to drive down inflation substantially.

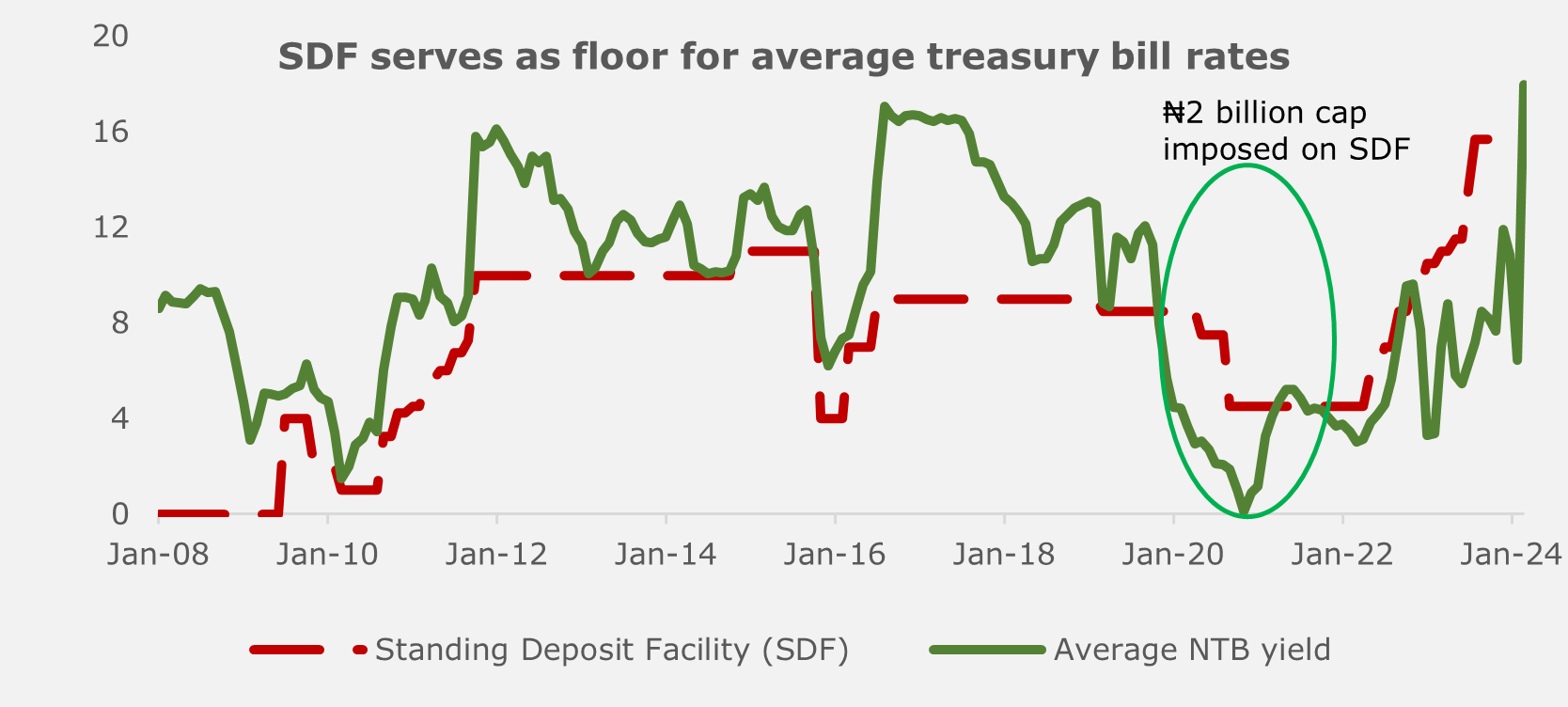

In addition, the Committee adjusted the asymmetric corridor around the MPR to +100/-700bps around the MPR. However, we note that the impact of the hike on the earning capacity of banks at the SDF window was neutralized by a 400bps reduction in the Standing Deposit Facility rate, as funds parked at the window will earn 15.75%. We note that the earlier removal of the ₦2 billion cap on interest-bearing deposits at the SDF window effectively improved the flow of funds from money markets (with single digit rates) to the window, contributing partly to the uptick in average NTB stop rates. While the SDF rate serves effectively as a floor for NTB rates, the uptick in NTB rates could raise the carry trade due to foreign portfolio investors who hedge using Non-Deliverable Forwards.

The hike in the CRR by 12.50ppts to 45%, a record high, was another huge tightening move. We note that since the discontinuation of irregular CRR debits, this move seeks to ensure liquidity is sterilized through official CRR adjustments. While the new official CRR figure is higher than historical effective CRR, this move consolidates on earlier moves to reduce the foreign currency holdings of banks and reduce the speculative impact of excess liquidity on the foreign exchange market.

Outlook: More eyes on the banks as MPC holds next month

We believe the MPC has sent the right signal to the markets with a 400bps hike in the MPR. While the next MPC meeting is slated for March, we believe the Committee would remain focused on attracting foreign portfolio investments. While a hold may strongly be in consideration given the short time span between the two meetings and the lag in monetary policy transmission, we could see more banking system-related adjustments, especially as the apex bank seeks to ease out distortions in the foreign exchange market. Thus, we could see room for either a hold or a slight 100 – 150bps adjustment to narrow the real rate of return, even as inflation edges above 30% from February onwards.