Analyst: Olumide Sole

4th Quarter Performance

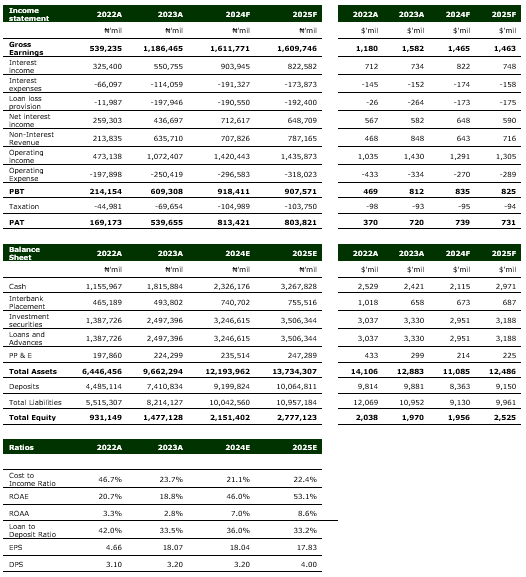

GTCO recently released its Q4’23 results, reporting a 92% y/y growth in Gross Earnings to ₦336 billion. This was driven by a 90% y/y rise in Interest Income to ₦176 billion (Vetiva: ₦175 billion), due to the expansion of the bank’s loan book and effective repricing of its assets. Meanwhile, Non-Interest Revenue (NIR) grew by 99% y/y to ₦154 billion, mainly due to a ₦108 billion FX revaluation gain.

Net Interest Income (NII) saw a 100% y/y improvement to ₦140 billion, despite a 59% y/y jump in Interest Expense to ₦37 billion, thanks to a 65% y/y increase in savings rate on customer deposits. On the other hand, Impairment charges rose by 5.0x to ₦49 billion, owing to unfavourable business climate exacerbated by policy reforms such as the removal of fuel subsidy and the devaluation of the Naira. These factors have significantly impacted the loan portfolio of banks, leading to increased provisions for potential credit losses. Also, Opex rose 16% y/y to ₦67 billion, due to a 36% y/y increase in staff costs, amid rising inflationary pressures. Overall, this led to a 296% and 344% y/y increase in PBT and PAT to ₦176 billion and ₦172 billion respectively.

FY 2023 – Full Year Performance

For its full-year performance, Gross Earnings grew by 120% y/y to ₦1.2 trillion, owing to growth in Interest Income and NIR which printed at ₦551 billion (+69% y/y) and ₦609 billion (+209% y/y) respectively. Hence, PBT and PAT grew by 185% and 219% y/y to ₦758 billion and ₦607 billion respectively.

Core banking to drive growth in 2024

Following the hike in the Monetary Policy Rate (MPR) by the CBN this year, and the expansion of the bank’s loan book by 32% to ₦2.5 trillion in 2023, we expect GTCO’s core banking performance to come in stronger in FY’24. Specifically, we see the bank’s Interest Income printing at ₦904 billion (+64% y/y), while Interest Expense is projected to come in at ₦191 billion (+68% y/y), due to the growth in customer deposits and higher savings rate. This yields a Net Interest Income of ₦713 billion (+63% y/y).

On the flip side, the quality of the bank’s assets may deteriorate, reeling from the effect of several macro headwinds including higher interest rate on loans following the hike in the MPR by 600bps, and inflationary pressures, which are expected to strain businesses and income, making loan repayments difficult for the bank’s customers. Hence, we envisage GTCO’s NPL ratio will come in higher at 4.5% (FY’23: 4.2%). Nonetheless, we still expect a strong performance as we anticipate a faster expansion in revenue line items relative to costs.

Meanwhile, NIR is projected to print at ₦693 billion (+12% y/y), owing to projected growth in Commission and Fees income to ₦149 billion (+20% y/y). Also, we expect the bank to record significant FX revaluation gains to the tune of ₦312 billion based on the depreciation of Naira, which we saw in the first quarter of the year; however, we do not expect the bank to record FX revaluation gains in subsequent quarters given that the bank had to close out its Net Open Position (NOP) in compliance with CBN’s guideline.

CBN’s reduction of Loan-to-deposit ratio (LDR) to improve earnings

Recently, the CBN announced its reduction of LDR for Deposit Money Banks (DMBs) to 50% from 65%. We believe this move is geared towards solidifying its monetary tightening stance. For context, with CRR increased to 45% from 32.5% and LDR at 65%, Nigerian banks had little or no assets to allocate to other return-yielding investments asides loans. Thus, the reduction in LDR will free up assets for Nigerian Banks to allocate to other return-generating instruments, such as T-bills, bonds etc..

Consequently, we expect this policy move by the CBN to reduce CRR debits as the banks find it easier to comply with the reduction in LDR.

Recapitalisation to spur long-term growth

Sequel to the CBN’s move to review upward the minimum capital requirements of Nigerian banks to improve their lending capacity, we estimate GTCO’s funding gap at ₦362 billion. We posit that the recapitalisation exercise would improve the earnings potential of the bank in the long run. However, in the near term, we expect GTCO’s number of outstanding shares to increase, which would in turn lead to a dilution of shareholders’ equity.

Issuance of additional shares in motion

In compliance with the CBN’s directives, the bank has announced its intention to raise additional capital of $750 million via the issuance of securities comprising of ordinary shares, convertible or non-convertible notes, bonds or any other instruments. Of note, the bank seeks to issue an additional 15 billion shares to increase its issued share capital. Based on this, we expect the bank’s number of shares outstanding to increase to 44.4 billion from 29.4 billion.

TP revised to ₦50.00 (Previous: ₦44.00)

Based on our new projections, we have increased our FY’24 PBT and PAT forecast to ₦919 billion (+51% y/y) and ₦816 billion (+51% y/y). However, in line with our expectation of a dilution of shareholders’ equity as result of the bank issuing additional shares, we expect a slight decrease in EPS to ₦18.04 (FY’23: ₦18.07) per share. Nonetheless, we revise our 12-month Target Price (TP) to ₦50.00 (Previous: ₦44.00). GTCO is currently trading at a P/B ratio of 0.73x and P/E ratio of 1.88x.

/*! elementor – v3.16.0 – 17-10-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}