Analyst: Olumide Sole*

o.sole@vetiva.com

Amid prevailing macroeconomic challenges and potential headwinds from external and domestic shocks, the Central Bank of Nigeria (CBN) announced the upward review of the minimum capital requirements for commercial, merchant, and non-interest banks in Nigeria. Consequently, the CBN looks to strengthen the capital buffers of Nigerian banks to drive growth in the economy through credit penetration.

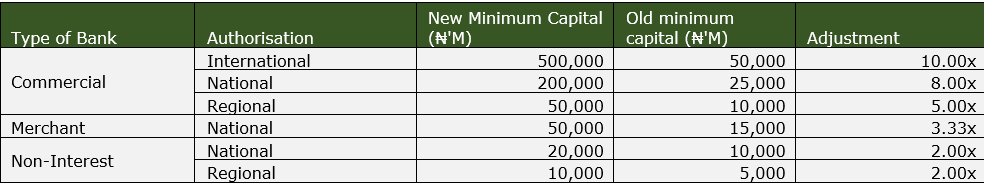

Provisions of the circular requirements are as follows:

• The minimum capital for commercial banks operating International, National, and Regional Bank licenses has been reviewed upward to ₦500 billion, ₦200 billion, and ₦50 billion; from ₦50 billion, ₦25 billion, and ₦10 billion, respectively.

• To meet the minimum capital requirements, banks are allowed to consider injecting fresh equity capital through private placements, right issue and/or offer for subscription, mergers & acquisitions (M&A), and/or upgrade or downgrade of license authorization only.

• For existing banks, the minimum capital shall comprise of paid-up capital and share premium only. This implies that the new capital requirement cannot be based on total shareholder’s fund of the banking entity.

• The new capital requirement is also applicable to new banking license applicants. Nevertheless, pending applications, for which capital deposit had been made or Approval in Principle had been granted, shall be processed by the CBN.

• All banks are required to meet the new capital requirement within a period of 24 months between April 1, 2024 and March 31, 2026. Also, banks are required to adhere strictly to the minimum capital adequacy ratio (CAR) requirements.

• All banks are required to submit a compliance plan for meeting the new capital requirement and activities involved not later than April 30, 2024.

A cursory look at the new requirements reveals that the minimum capital for commercial banks with international, national, and regional licenses was increased by 10x, 8x, and 5x, respectively. The capital requirement for merchant banks was reviewed upward by 3.3x. The minimum capital requirements for non-interest banks – with national or regional licenses – were doubled.

/*! elementor – v3.16.0 – 17-10-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}

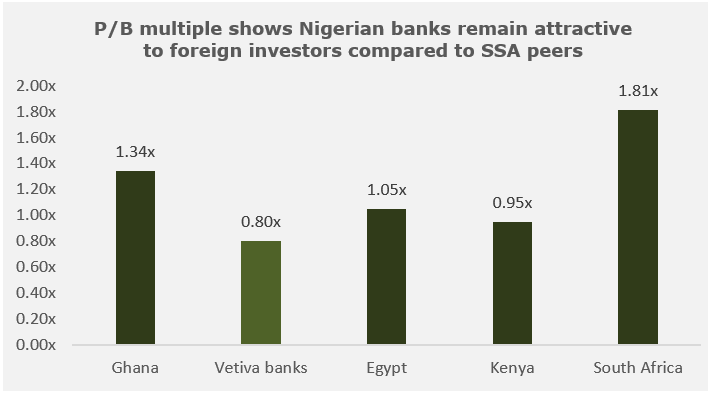

We see banks raising fresh capital via private placements, right issues, or offer for subscription. We expect Nigerian banks to seek fresh capital inflows from both domestic and foreign investors to meet the new capital requirements, and banks that cannot meet the new capital requirement will likely merge or be acquired.

Given the crucial role that banks play in the economy, we believe that the CBN, with this move, aims to improve the quality of capital held by Nigerian banks, ensure strong capital buffers to catalyse/support economic growth, and ensure that they have a robust capital base to absorb potential losses and withstand systemic shocks, which could arise domestically or externally. Also, improving the capital base of Nigerian banks will likely improve the earnings potential of these banks within the context of increased capacity for larger transactions. However, we expect loan book expansion for Nigerian banks to be hindered by the high Cash Reserve Ratio (CRR) of 45% in the near term.

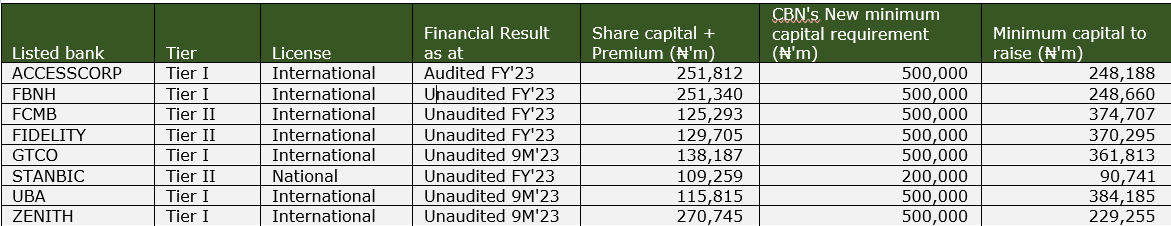

Our analysis reveals that our coverage banks including ETI, STERLING, UNIONBANK, UNITYBANK, and WEMABANK would require additional capital to plug the funding gap estimated at ₦3.3 trillion. We opine that, based on the size of funding required across the industry, Banks will also seek foreign capital to augment domestic investment capacity.

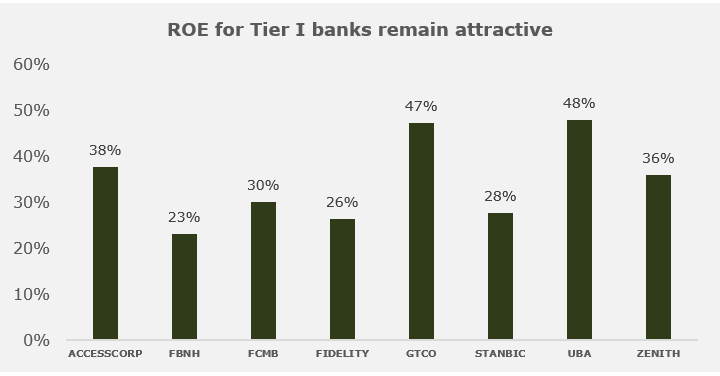

Also, we believe that investors could weigh the opportunity cost of investing in either tier I or II banks. We anticipate a preference for tier I banks because they have a higher Return on Equity (ROE) relative to their Cost of Equity (CoE). This implies that tier-I banks may crowd out available funding at the expense of their tier-II counterparts. Consequently, we posit that tier-II banks could augment fresh capital raise with mergers and acquisitions and possible license downgrade to address any capital deficiencies.

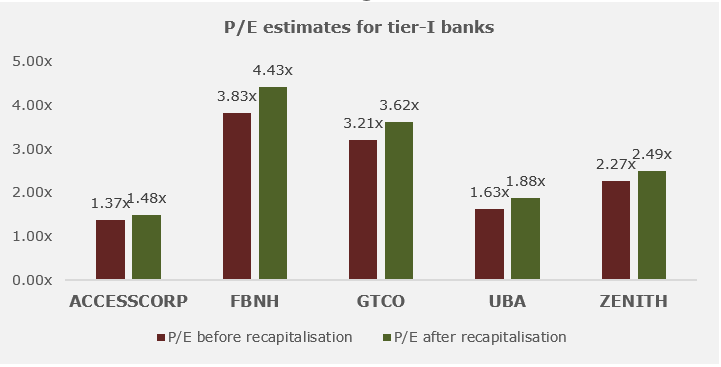

From a valuation perspective, we believe that fresh capital raises would cause the number of outstanding shares to increase which would in turn result in a dilution of shareholders’ equity in the short term as this could lead to a decline in Earnings Per Share (EPS). However, in the long run, we expect that the potential earnings from the additional capital could offset the dilution.

Lastly, we estimate that Price to Earnings ratio (P/E) after recapitalization would increase marginally owing to the effect of dilution in EPS. However, compared to SSA peers (3.5x), the estimated P/E ratios for Nigerian banks (2.8x) imply that they would still be trading at a discount even after recapitalization.