Analyst: Olumide Sole*

Target price: ₦29.00

Rating: HOLD

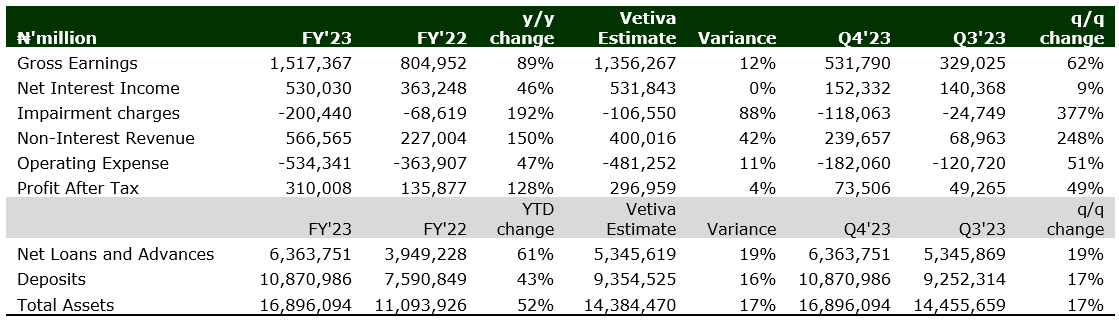

FBNH released its Q4’23 results, showing a 106% y/y jump in Gross earnings to ₦532 billion (Vetiva: ₦371 billion). As with other banks, the strong growth was due to a 56% y/y rise in Interest Income to ₦281 billion (Vetiva: ₦286 billion), owing to the expansion of the bank’s loan book by 68% y/y amid elevated interest rates. Similarly, the bank’s Non-Interest Revenue (NIR) grew by 243% y/y to ₦239 billion (Vetiva: ₦73 billion), on the back of material FX revaluation gains of ₦180 billion.

Meanwhile, Interest Expense grew by 94% y/y to ₦131 billion (Vetiva: ₦132 billion), resulting in Net Interest Income of ₦152 billion (+34% y/y), 1% below our estimate of ₦154 billion.

On the cost front, impairments on loan losses grew by 270% y/y to ₦118 billion. Meanwhile, Opex grew 83% y/y to ₦182 billion and the bank’s cost-to-income ratio came in at 49% in FY’23 (FY’22: 62%). Overall, the bank reported a PBT of ₦92 billion (+76% y/y), while PAT was 65% higher y/y at ₦74 billion.

CBN’s revised CRR management to incentivize loan book growth

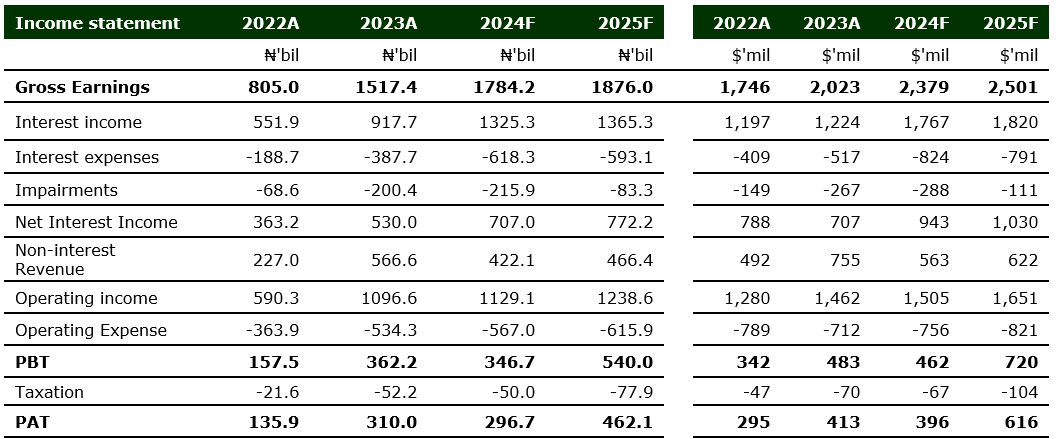

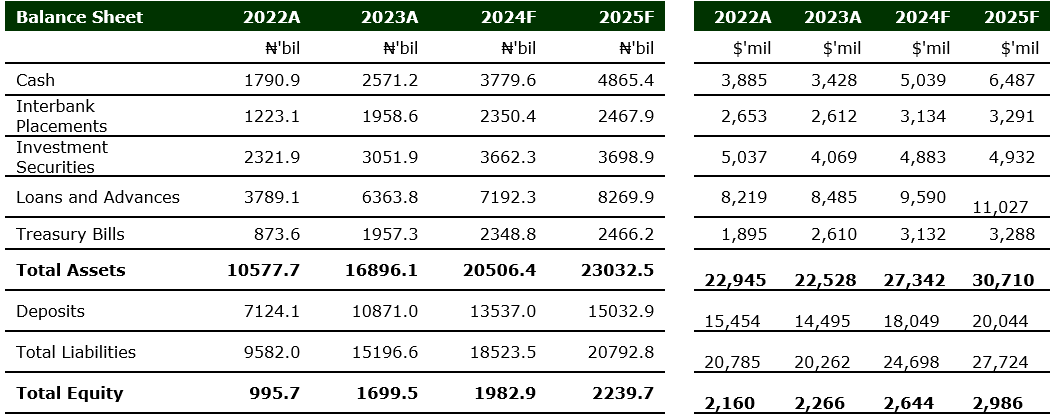

Sequel to the recent circular, where the Central Bank of Nigeria (CBN) introduced a policy requiring a 50% Cash Reserve Ratio (CRR) debits of lending shortfall on Nigerian banks, our analysis of the policy in respect to the bank revealed that the new CRR debits of 50% will worsen the effective CRR of the bank which prints at 33.6% in FY’23, if the bank does not shore up its LDR. Therefore, we opine that this could potentially incentivize the bank to meet the regulatory minimum LDR of 65% (FY’23: 61%) in 2024, which would in turn improve loan book growth and core banking income. That said, we expect Interest Income to grow by 44% y/y to ₦1.3 trillion, owing to loan book expansion and expectation of higher interest rates.

Similarly, our projection for Interest Expense stands at ₦618 billion (Previous: ₦544 billion), thereby resulting in Net Interest Income of ₦707 billion (+33% y/y).

Net Open Position (NOP) limit to impact FX revaluation gains

Last week, the CBN released a circular requiring banks to close their long FCY NOP or limit their short FCY NOP to 20% of Shareholders Fund (SF) on or before February 1, 2024. Meanwhile, our analysis revealed that FX revaluation gains contribution to NIR was 65%, which implies that FX revaluation gains had a significant impact on 2023 results. In 2024, we expect FX revaluation gains of ₦193 billion in Q1’24 to propel NIR; however, we do not expect to see significant FX revaluation gains/losses in subsequent quarters due to the deadline of the CBN guideline which is effective February 1, 2024.

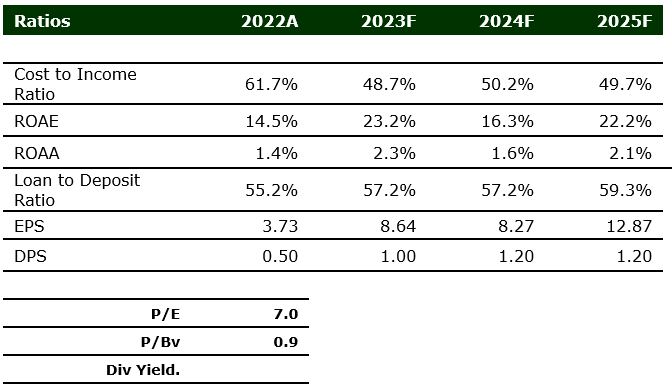

TP revised upward to ₦29.00 (Previous: ₦23.00)

Looking ahead, we increase our PBT and PAT forecast to ₦539 billion (Previous: 407 billion) and ₦462 billion (Previous: ₦350 billion) respectively. Therefore, we revise our 12-month Target Price (TP) upward to ₦29.00 and recommend a HOLD.

/*! elementor – v3.16.0 – 17-10-2023 */

.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block}