Click here to download report...

Category Archives: Consumer goods

Click here to download report...

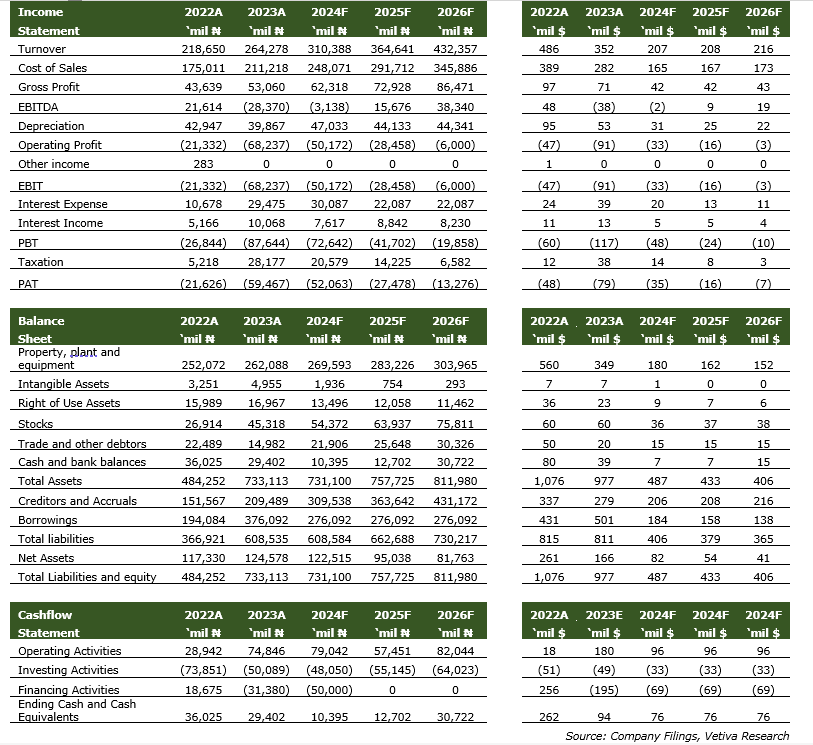

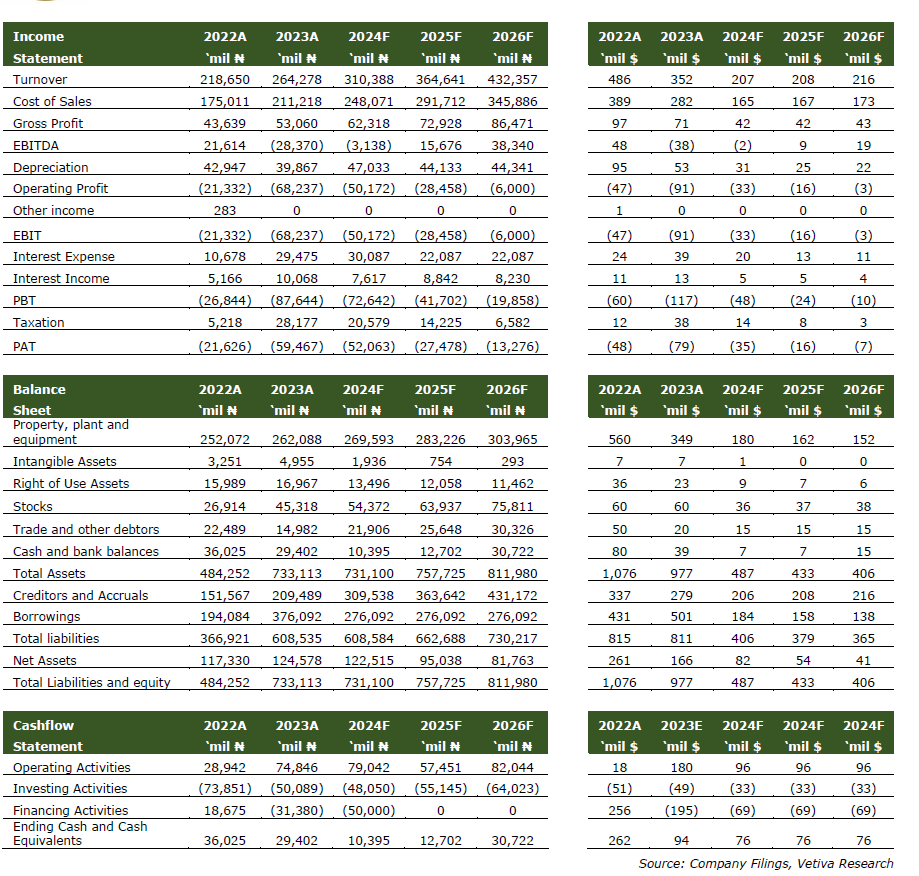

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦35.91 Rating: SELL TL;DR Revenue: ₦594.6 billion, marking an impressive 51% y/y increase. Profit After Tax: ₦8.26 billion, showcasing a substantial 91% y/y increase. Net operating losses (FX impacted): ₦77 billion loss as against ₦4.2 billion gain in Q3’23. Q3 revenue growth expands gross margin In the third quarter...

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦5.90 Rating: HOLD TL;DR Impressive 38% y/y growth in Q4’23 revenue, reaching ₦80.5 billion. Remarkable 126% y/y growth in gross profit in Q4’23 to ₦14.4 billion. Significant FX losses and finance costs of ₦43.1 billion sunk PAT to ₦33.8 billion loss in Q4’23. Pricing increases elevate topline In...

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦5.90 Rating: HOLD TL;DR Robust 27% y/y revenue growth in Q2’24, reaching ₦83.1 billion. Y/y increase in EBIT (28%) faster than gross profit (16%) in Q2’24. Loss after tax of ₦8.7 billion in Q2’24 due to FX losses, as against ₦1.3 billion profit in Q2’23. Revenue growth and cost...

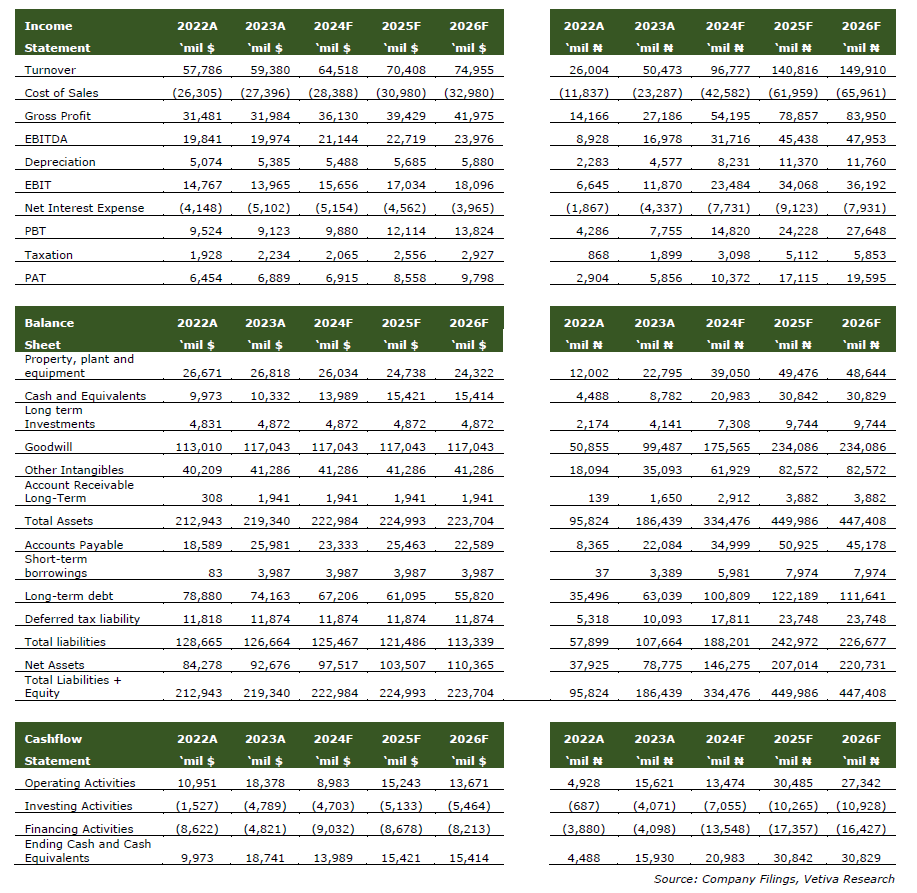

Analyst: Oluebube Nwosu*o.nwosu@vetiva.comTarget price: R1251.04Rating: HOLD TL;DR Q4’23 revenue declines 1% y/y to $14.5 billion. OPEX jumps 30% y/y to $5.1 billion in Q4’23. PAT declines 31% y/y to $2.3 billion in Q4’23. Volume decline drags revenue performance AB InBev’s revenue for the Q4 period fell marginally (-1% y/y) to $14.5 billion. This came as...