Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦25.64 Rating: SELL TL;DR Q4’23 revenue grows by 26% y/y to ₦197.8 billion. Q4’23 net finance expenses jump 4.6x as FX losses and finance costs hit ₦66.4 billion and ₦17.5 billion respectively. Q4’23 loss came in at ₦49.1 billion (Q4’22: ₦1.6 billion loss). Robust revenue growth in a challenging...

Author Archives: R. Daniels Chidozie

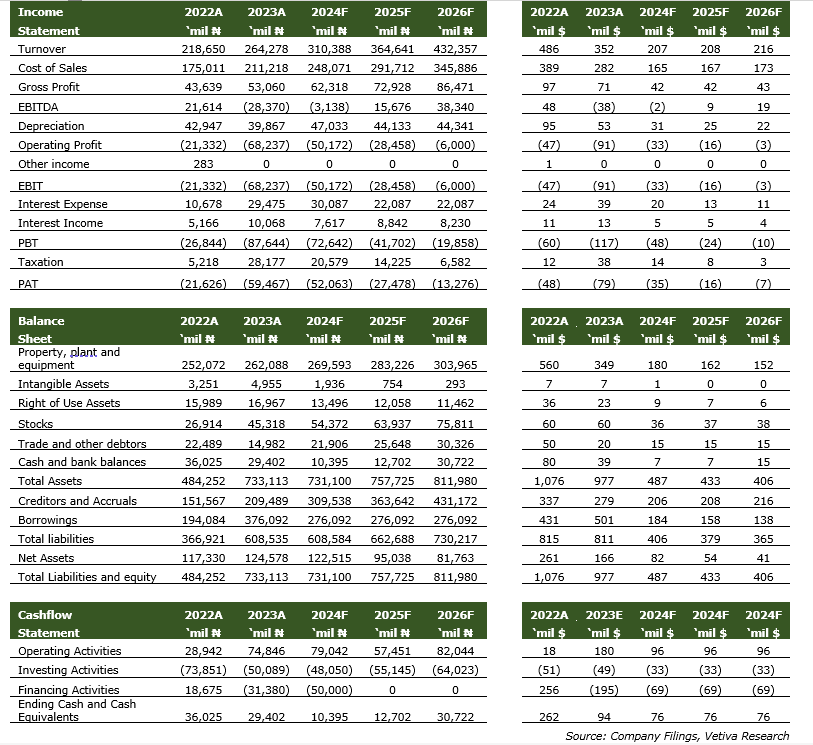

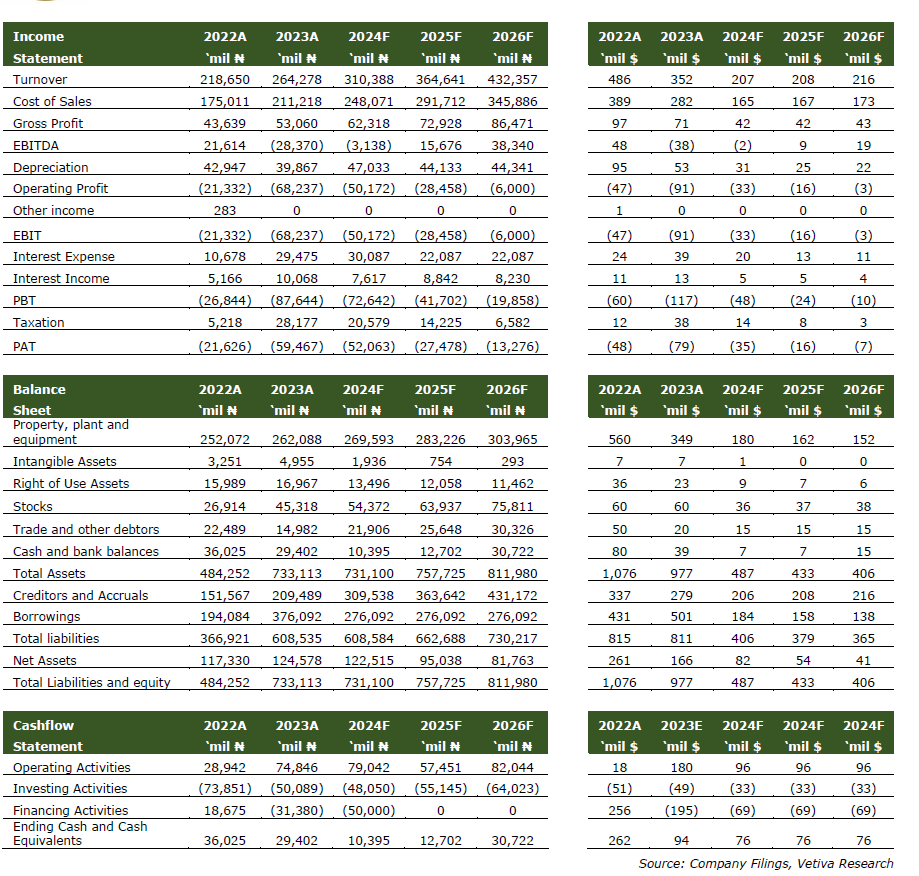

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦5.90 Rating: HOLD TL;DR Impressive 38% y/y growth in Q4’23 revenue, reaching ₦80.5 billion. Remarkable 126% y/y growth in gross profit in Q4’23 to ₦14.4 billion. Significant FX losses and finance costs of ₦43.1 billion sunk PAT to ₦33.8 billion loss in Q4’23. Pricing increases elevate topline In...

Analyst: Ibukun Omoyeni i.omoyeni@vetiva.com The Nigerian Bureau of Statistics (NBS) recently introduced a valuable tool for understanding Nigerians’ access to healthy food, the Cost of Healthy Diet (CoHD) Index. This index sheds light on the affordability of a nutritious diet, offering insights beyond traditional inflation measures. The CoHD reflects the least expensive combination of locally...

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦5.90 Rating: HOLD TL;DR Robust 27% y/y revenue growth in Q2’24, reaching ₦83.1 billion. Y/y increase in EBIT (28%) faster than gross profit (16%) in Q2’24. Loss after tax of ₦8.7 billion in Q2’24 due to FX losses, as against ₦1.3 billion profit in Q2’23. Revenue growth and cost...

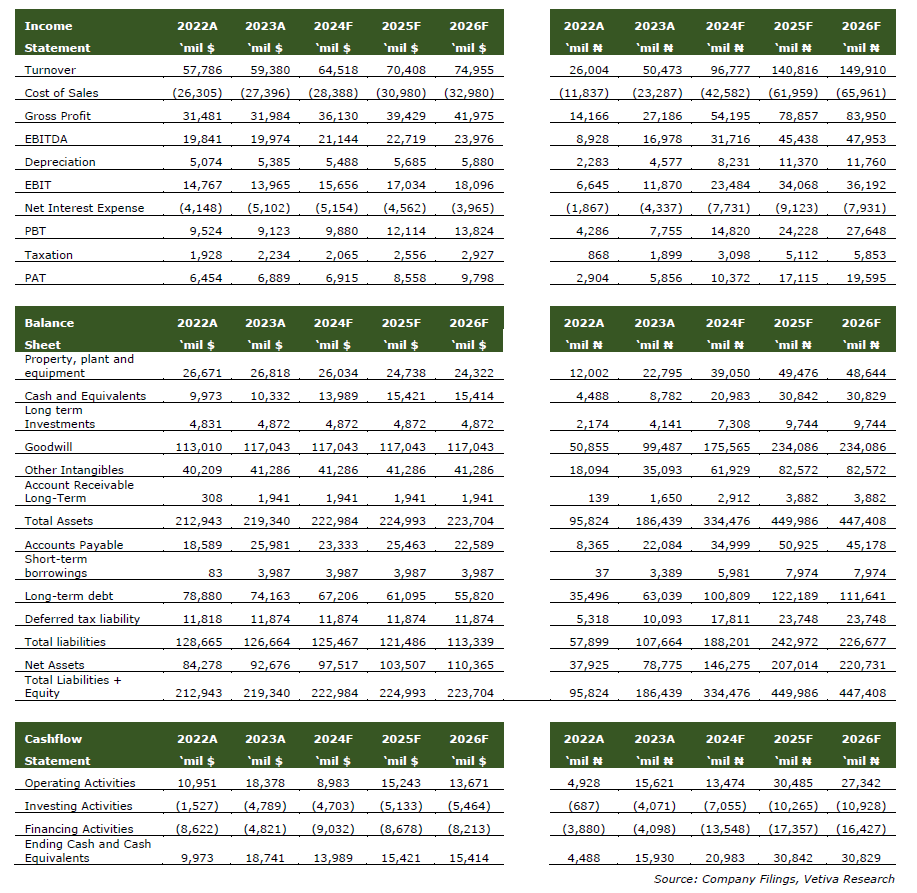

Analyst: Oluebube Nwosu*o.nwosu@vetiva.comTarget price: R1251.04Rating: HOLD TL;DR Q4’23 revenue declines 1% y/y to $14.5 billion. OPEX jumps 30% y/y to $5.1 billion in Q4’23. PAT declines 31% y/y to $2.3 billion in Q4’23. Volume decline drags revenue performance AB InBev’s revenue for the Q4 period fell marginally (-1% y/y) to $14.5 billion. This came as...

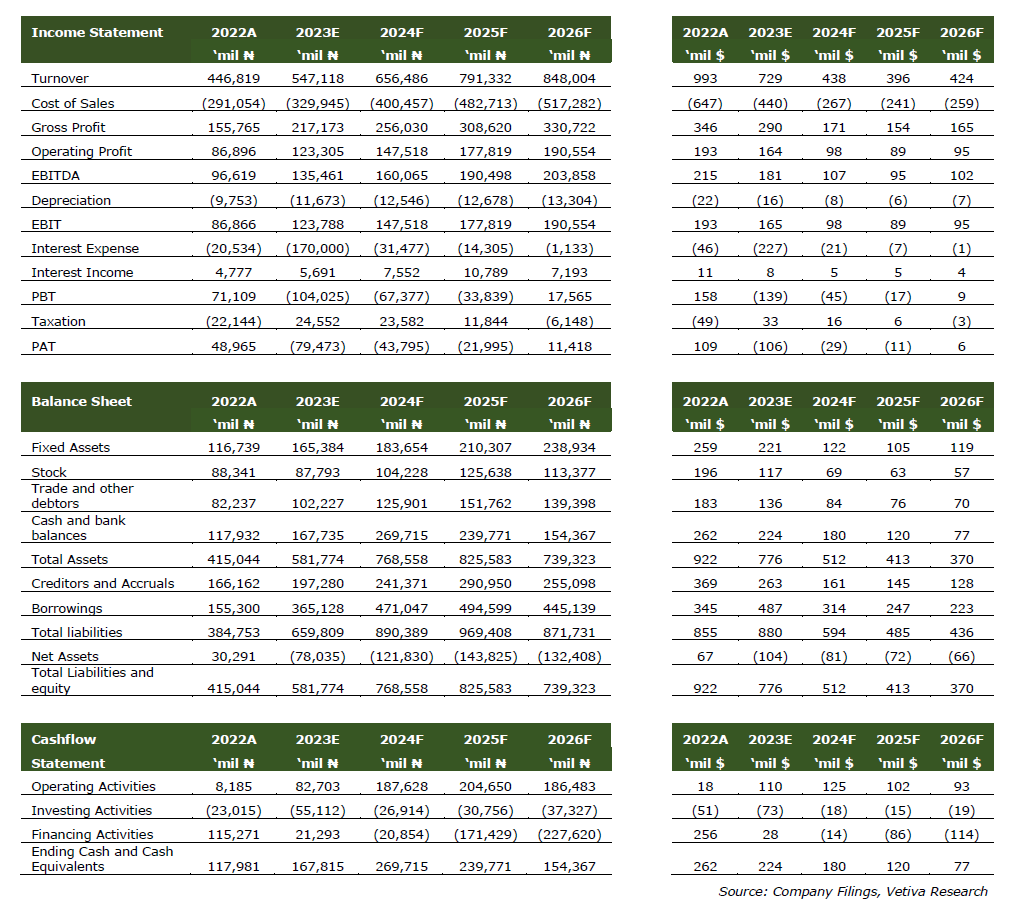

Analyst: Oluebube Nwosu* o.nwosu@vetiva.com Target price: ₦1006.52 Rating: HOLD TL;DR Q4 revenue jumped 33% y/y to ₦150.5 billion. Net finance expenses surged 8x in Q4’23, reaching ₦79.6 billion. Given a mixed bag performance and outlook, we maintain a HOLD rating Price jump combats volume decline Nestle Nigeria showcased remarkable resilience in Q4’23, achieving a substantial...