Nigerian equities kicked off 2024 on a strong note, as the NGXASI gained 35.3% in January. Likewise, the positive performance filtered into our picks for 2024, with our conviction stocks returning 12.6% in the same period. Starting with the financial services space, our banking picks had a mixed showing. While FCMB returned an outstanding 20.9%...

Author Archives: R. Daniels Chidozie

Analyst: Abigail Alabi* a.alabi@vetiva.com Target price: ₦250.97 Rating: SELL PRESCO recently released its unaudited FY’23 earnings, reporting a 133% y/y growth in PAT to ₦30.4 billion. Volume fuels PRESCO’s revenue growth In Q3’24, revenue growth of 20% y/y to ₦26 billion, was delivered through a combination of increased volume and higher pricing amidst strong demand....

Analyst: Oluebube Nwosu*o.nwosu@vetiva.comTarget price: ₦35.91Rating: SELL Q3 revenue growth expands gross marginIn the third quarter of FMN’s fiscal year 2024 (Oct to Dec ‘23), the company exhibited an exceptional performance, with revenue skyrocketing to ₦594.6 billion, a substantial 51% increase compared to Q3’23. This remarkable growth came about by a mix of volume growth and...

Analyst: Ibukun Omoyeni*I.omoyeni@vetiva.com Lower oil prices moderate inflation in most SSA economies In 2023, headline inflation fell in 6 out of the top 10 economies in Africa. This can be linked to lower energy prices. The largest decline was recorded in Angola (-8.1 ppts), Ethiopia (-3.6 ppts) and South Africa (-0.9 ppts). The largest uptick...

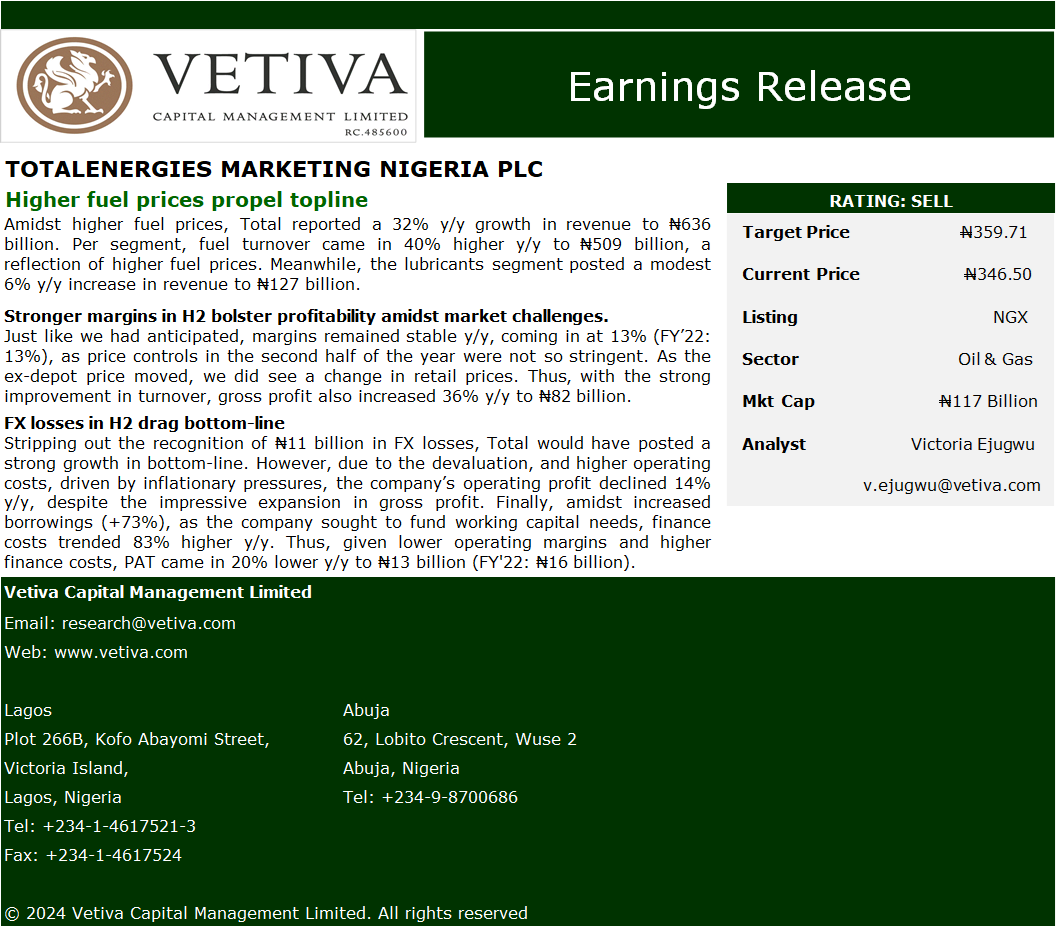

Analyst: Victoria Ejugwu* Target price: ₦359.71 Rating: SELL Amidst higher fuel prices, Total reported a 32% y/y growth in revenue to ₦636 billion. Per segment, fuel turnover came in 40% higher y/y to ₦509 billion, a reflection of higher fuel prices. Meanwhile, the lubricants segment posted a modest 6% y/y increase in revenue to ₦127...

Analyst: Abigail Alabi* Target price: ₦256.95 Rating: SELL OKOMUOIL released its unaudited FY’23 earnings results, reporting a strong PAT growth of 22% y/y, which was bolstered by the surge in sales. OKOMUOIL rides export surge Amid the stable global CPO prices and strong local demand, revenue for the Q4’23 period increased by 58% y/y to ₦14...